The JPMorgan Guide to the Market is a comprehensive resource offering insights into market trends, data, and strategies for investors. It provides historical context, tools for portfolio construction, and risk management techniques, making it invaluable for both professionals and newcomers seeking to navigate complex financial landscapes effectively.

1.1 Overview of the Guide

The JPMorgan Guide to the Market is a detailed resource designed to help investors navigate financial markets. It provides insights into market trends, historical data, and economic forecasts. The guide is structured to offer a clear understanding of global equity, fixed income, and alternative investments. It includes tools for portfolio construction and risk management, making it a valuable tool for both novice and experienced investors. The guide’s comprehensive approach ensures users can make informed decisions based on data-driven analysis and expert insights.

1.2 Importance of the Guide for Investors

The JPMorgan Guide to the Market is an essential resource for investors seeking to make informed decisions. It offers a wealth of data, analysis, and insights, enabling investors to understand market trends and economic conditions better. By providing historical context and forecasting tools, the guide helps investors identify opportunities and manage risks. Its comprehensive approach makes it a trusted source for both novice and experienced investors, offering a competitive edge in navigating complex financial markets effectively.

Key Features of the JPMorgan Guide to the Market

The guide offers comprehensive market data, historical trends, and portfolio construction tools. It provides insights into risk management and utilizes clear charts to simplify complex financial information for investors.

2.1 Comprehensive Market Data and Analysis

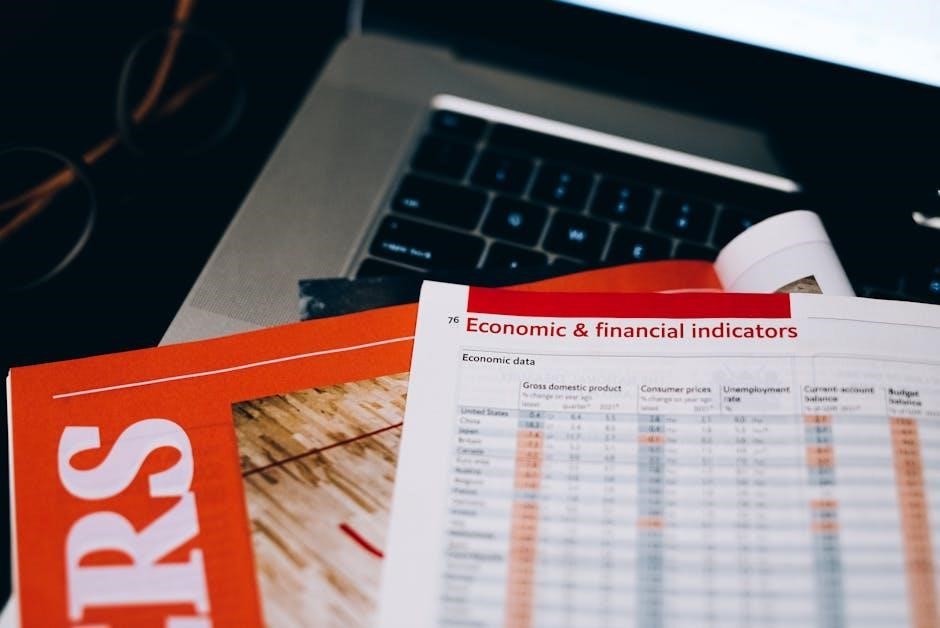

The JPMorgan Guide to the Market provides comprehensive market data and analysis, offering investors a detailed perspective on global markets. It includes up-to-date statistics, trends, and insights, enabling users to make informed decisions. The guide simplifies complex financial information through clear charts and graphs, covering equities, fixed income, and alternative investments. By leveraging JPMorgan’s expertise, the guide delivers a global market outlook, helping investors understand opportunities and risks across various asset classes and regions.

2.2 Historical Market Trends and Statistics

The JPMorgan Guide to the Market includes detailed historical market trends and statistics, providing a robust foundation for understanding past market behaviors; It offers extensive data on equity, fixed income, and alternative investments, allowing investors to analyze long-term patterns and cycles. The guide presents this information through charts and graphs, making complex historical data accessible. By examining these trends, investors can identify opportunities, anticipate potential challenges, and make more informed decisions based on actionable insights from decades of market history.

2.3 Tools for Portfolio Construction and Risk Management

The JPMorgan Guide to the Market offers advanced tools for portfolio construction and risk management. These tools enable investors to analyze market conditions, assess potential risks, and build diversified portfolios tailored to their goals. The guide includes portfolio analyzers, stress-testing frameworks, and scenario analysis to help investors navigate volatility. By leveraging these tools, investors can optimize their strategies, mitigate risks, and achieve better long-term outcomes. These resources empower both novice and experienced investors to make informed decisions confidently.

Understanding Market Trends

The JPMorgan Guide to the Market provides in-depth analysis of global equity trends, fixed income insights, and alternative investment patterns, helping investors navigate market shifts effectively.

3.1 Global Equity Market Trends

The JPMorgan Guide to the Market provides detailed insights into global equity trends, highlighting performance across regions and sectors. It analyzes market volatility, economic factors, and geopolitical impacts on equities. The guide also explores emerging market opportunities and technological advancements driving growth. Investors gain a clear understanding of long-term trends, enabling informed decisions. Key insights include sector-specific performance and shifting investor preferences, such as the rise of ESG-focused investments. This section equips readers with actionable data to navigate the complex global equity landscape effectively.

3.2 Fixed Income Market Insights

The JPMorgan Guide to the Market offers in-depth analysis of fixed income trends, focusing on bond market performance, interest rate dynamics, and credit spreads. It provides insights into macroeconomic factors influencing debt markets, such as inflation and monetary policy. The guide also explores investment strategies for navigating fixed income portfolios amid volatility. Key highlights include sector-specific bond performance and emerging opportunities in fixed income securities. This section is crucial for investors seeking to optimize returns and manage risks in the fixed income space effectively.

3.3 Alternative Investment Trends

The JPMorgan Guide to the Market delves into alternative investment trends, highlighting opportunities in private equity, hedge funds, and real assets. It explores how investors are diversifying beyond traditional equities and bonds. The guide emphasizes the growing interest in ESG-aligned investments and sustainable growth strategies. Additionally, it provides insights into emerging markets and alternative asset classes, such as cryptocurrencies and infrastructure investments. These trends are supported by detailed data and analysis, helping investors make informed decisions in the evolving alternative investment landscape.

Economic Insights and Forecasts

JPMorgan Guide to the Market provides detailed economic insights and forecasts, analyzing key macroeconomic factors and regional trends to help investors anticipate future market conditions effectively.

4.1 Macroeconomic Factors Impacting the Market

The JPMorgan Guide to the Market thoroughly examines macroeconomic factors influencing global markets, such as policy changes, inflation trends, and monetary shifts. It highlights how these elements shape market dynamics, offering insights into their potential impacts on investments. By analyzing these factors, investors can better understand economic cycles and make informed decisions. The guide also explores the effects of geopolitical events and regulatory changes, providing a holistic view of the economic landscape and its implications for portfolio management and risk assessment.

4.2 Regional Economic Trends and Outlook

The JPMorgan Guide to the Market provides in-depth analysis of regional economic trends, highlighting growth prospects and challenges across key regions. It emphasizes emerging markets’ potential, particularly in Asia-Pacific and Latin America, while addressing slowdowns in developed economies. The guide also explores sector-specific opportunities, such as technology and renewable energy, and offers insights into how regional policies and geopolitical shifts may shape future economic landscapes. This section equips investors with a nuanced understanding of diverse markets, enabling strategic decision-making tailored to regional dynamics and growth trajectories.

Investment Strategies

The JPMorgan Guide highlights effective investment strategies, emphasizing diversification, risk management, and aligning portfolios with market trends. It offers insights into balancing equities, fixed income, and alternatives for optimal returns.

5.1 Portfolio Diversification Techniques

Portfolio diversification is a cornerstone of effective investing, and the JPMorgan Guide provides strategies to spread investments across asset classes, sectors, and geographies. By balancing equities, fixed income, and alternatives, investors can reduce risk and enhance returns. The guide emphasizes the importance of aligning diversification strategies with individual financial goals and risk tolerance. It also offers practical advice on avoiding overexposure to volatile markets, ensuring a balanced approach that adapts to changing economic conditions and market trends.

5.2 Risk Management in Volatile Markets

Risk management is crucial in volatile markets, and the JPMorgan Guide offers tailored strategies to mitigate potential losses. Techniques include stress testing, diversification, and dynamic hedging to safeguard portfolios from market fluctuations. The guide highlights the importance of monitoring macroeconomic factors and leveraging data analytics for informed decision-making. By adopting these strategies, investors can navigate uncertainty with confidence, ensuring their portfolios remain resilient during periods of heightened market volatility and economic instability;

Emerging Markets and Opportunities

The JPMorgan Guide highlights growth prospects in emerging markets, offering insights into investment opportunities in regions like Africa and strategies to navigate these dynamic economies.

6.1 Growth Prospects in Emerging Economies

The JPMorgan Guide emphasizes the potential of emerging economies, driven by urbanization, innovation, and expanding middle classes. It highlights growth hotspots like Africa, detailing sectors poised for expansion. The guide provides insights into navigation strategies, helping investors identify opportunities while managing risks in these dynamic markets. By leveraging data and analytics, the guide equips investors to capitalize on emerging trends and foster sustainable growth in these regions.

6.2 ESG Investing and Sustainable Growth

The JPMorgan Guide highlights ESG investing as a cornerstone of sustainable growth, offering strategies to align portfolios with global sustainability goals. It provides insights into ESG trends, metrics, and tools, enabling investors to make informed decisions that balance returns with environmental and social impact. By integrating ESG factors, the guide helps investors navigate risks and opportunities, fostering long-term value creation while contributing to a more sustainable future.

Using the Guide for Investment Decisions

The JPMorgan Guide to the Market serves as a valuable tool for investors, offering data and insights to make informed decisions, support portfolio construction, and manage risk effectively.

7.1 Practical Applications of the Guide

The JPMorgan Guide to the Market offers practical applications for investors, providing clear charts and data to illustrate market trends and economic histories. It serves as a tool to inform portfolio decisions, offering insights into global equity trends, fixed income markets, and alternative investments. Investors can use the guide to analyze historical statistics, identify emerging opportunities, and apply risk management strategies. By leveraging the guide’s comprehensive analysis, investors can make more informed decisions tailored to their financial goals and market conditions.

7.2 Case Studies of Successful Market Strategies

The JPMorgan Guide to the Market includes real-world case studies highlighting successful investment strategies. These examples demonstrate how historical data and trend analysis informed profitable decisions. From navigating volatile markets to leveraging emerging opportunities, the guide provides actionable insights. Case studies cover diverse regions, such as Asia-Pacific and Latin America, showcasing tailored approaches. By examining these strategies, investors can gain practical knowledge to refine their own investment techniques and adapt to changing market conditions effectively.

The JPMorgan Guide to the Market offers invaluable insights, equipping investors with data-driven strategies and forward-looking perspectives. As markets evolve, this guide remains a cornerstone for informed decision-making and sustained success in dynamic financial landscapes.

8.1 Summary of Key Takeaways

The JPMorgan Guide to the Market provides a comprehensive overview of market trends, economic insights, and investment strategies. It equips investors with practical tools for portfolio construction and risk management, while offering historical context and forward-looking forecasts. Key takeaways include the importance of diversification, the role of emerging markets, and the value of ESG investing. By leveraging data-driven insights, the guide enables investors to navigate volatile markets and make informed decisions aligned with their long-term financial goals, ensuring resilience and growth in dynamic economic environments.

8.2 Future Outlook and Recommendations

The JPMorgan Guide to the Market emphasizes the importance of staying ahead of market dynamics. Investors are encouraged to adopt a forward-looking approach, leveraging diversification and emerging market opportunities. ESG investing is highlighted as a key driver of sustainable growth. The guide recommends maintaining a long-term perspective, adapting to economic shifts, and utilizing data-driven strategies; By aligning portfolios with these insights, investors can navigate future uncertainties and capitalize on growth prospects, ensuring resilience and success in evolving financial landscapes.